Frequently asked questions (FAQ)

ANSWER:

1. Contribute towards a retirement fund

2. Open up a Tax Free Savings Account

3. Donate to a SARS registered charity

4. Join a Medical Aid Scheme

5. Keep a logbook if you receive a travel allowance

6. Keep a logbook if you drive a company car

7. Claim commission related expense if you are a commission earner

8. Claim business travel if you are a commission earner

9. Claim your daily costs if you receive a subsistence allowance

10. Claim expenses if you earn non-salary income

ANSWER:

No individual taxpayer or tax situation is too complicated for us to handle. The only section we do not complete for people is the Farming section, which we hope doesn’t affect too many of you. So from foreign dividends to local business, from independent contractors to capital gains – you name it – Jc Tax Solutions is perfectly suited to take care of any tax situation and complete and submit your tax return to SARS, whether it’s simple or complicated.

ANSWER:

Our team of experienced accountants will redo your financials in order to establish if the SARS claims are correct and will advise you on any action required.

ANSWER:

For an individual, the tax year runs from 1 March until 28/29 February of the following year.

![]()

ANSWER:

Yes, we certainly do!

We guide you through the document submission process by clarifying which supporting documents you need to submit and then sending those documents to SARS for you.

This means you don’t need to use eFiling to submit, which can be very frustrating and time-consuming due to the way they communicate their requirements.

We also help with the dispute resolution / objection process if applicable (although there may be a fee charged depending on the complexity of the dispute.

ANSWER:

An IRP5 is the employee’s tax certificate that is issued to him/her at the end of each tax year detailing all employer/employee related incomes, deductions and related taxes.

It is used by the employee specifically to complete his/her income tax return for a specific year.

ANSWER:

You are able to claim the amount that you paid for our service as a deduction on your tax return. SARS only allows accounting fees deduction for freelancers, sole proprietors and individuals that earn other income such as rental income.

ANSWER:

Once submitted, SARS are intending to speed things up a bit this year and have committed to complete their review within 21 business days provided the return is for the current year and all supporting documents have been received.

If SARS advances their review to an “audit” stage you will be advised as such and after you have submitted all supporting documents, SARS should complete their audit within 90 business days.

SARS has changed things up a bit this year and advised that they have 7 business days in which to pay out a refund, if no audit. Taxpayers have been known to receive their refunds within 2-3 days, however, let’s hold thumbs!

ANSWER:

You are only able to claim travel expenses as a tax deduction if you traveled for business related reasons AND kept a valid logbook AND you fit into one of these categories:

– You received a travel allowance (source code 3701 or 3702 on your IRP5) or,

– You have a company provided vehicle (source code 3802 or 3816 on your IRP5) or,

– You are a commission earner, independent contractor or sole proprietor.

ANSWER:

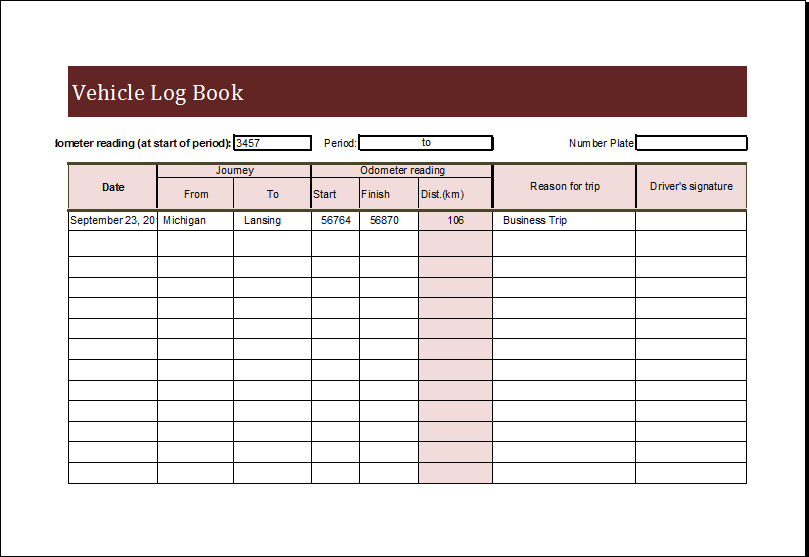

The logbook should contain a detailed record of your business mileage for the tax year. It must include opening odometer and closing odometer reading and full details of business mileage and private mileage for each trip i.e date, starting point, destination, kms, reason for trip.

ANSWER:

Donations are only tax deductible if they are made to a registered Public Benefit Organisation (PBO) and they are able to supply you with a Section 18A tax certificate.

![]()

ANSWER:

Yes. It is however advisable that you use a professional service to achieve this, as the process to set up a repayment arrangement can be complicated.

ANSWER:

If you make a payment to SARS and provided you use the correct payment reference number; SARS should allocate the payment to your account within 3 business days.

ANSWER:

1. Tax season deadline reminders so you never forget to submit on time.

2. An online document storage facility to keep important tax certificates safe.

3. Discussions and reviews by our tax practitioner before submission to SARS.

4. Online support from expert tax practitioners throughout the process.

5. Assistance with supporting documents submission, if audited by SARS.

6. Assistance with dispute resolution / objection process, if applicable. (Note there may be an additional fee charged depending on the complexity of the dispute).

7. Last but not least, peace of mind when doing your taxes.